extrade2

Comprehensive Exness ECN Account Review Pros, Cons, and Features

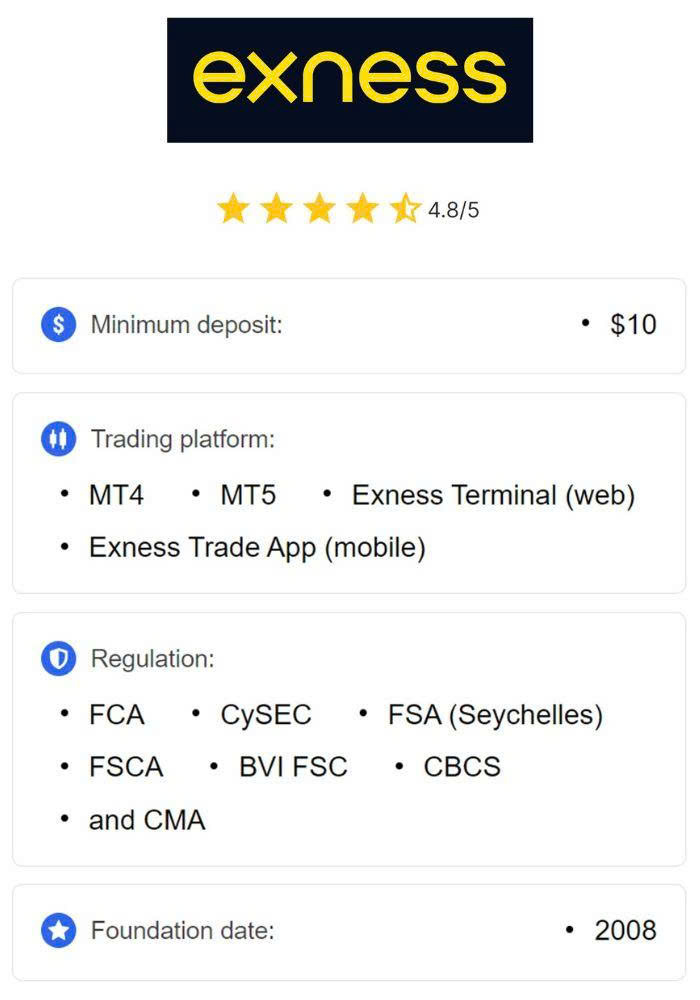

Exness ECN Account Review

The exness ecn account review Exness trading platform has gained a reputation for its reliable services and user-friendly interface. One of the key services offered by Exness is the ECN (Electronic Communication Network) account, which is particularly popular among professional traders looking for low spreads and high execution speeds. This review will delve into the specifics of the Exness ECN account, covering its features, benefits, trading conditions, and potential downsides, providing you with a comprehensive understanding of this trading option.

What is an ECN Account?

An ECN account allows traders to access real market prices by connecting to liquidity providers. Unlike traditional trading accounts where trades are executed through a broker’s dealing desk, ECN accounts facilitate direct interaction between buyers and sellers. This results in tighter spreads, faster executions, and potentially enhanced profitability, particularly for high-frequency traders or those who utilize scalping strategies.

Features of Exness ECN Accounts

Exness ECN accounts offer several attractive features that cater to professional traders:

- Low Spreads: One of the standout features of the Exness ECN account is its low spread, often starting at 0.0 pips. This is beneficial for traders interested in maximizing their profits by minimizing trading costs.

- Fast Execution: The ECN account is designed to provide rapid execution speeds, ensuring that orders are filled without delay, which is crucial for scalping and day trading strategies.

- Access to Multiple Markets: Traders using Exness ECN accounts can access a wide range of markets, including forex, commodities, indices, and cryptocurrencies, making it a versatile option for diversified trading.

- No Dealing Desk Intervention: With an ECN account, the broker acts purely as an intermediary, meaning trade execution is not influenced by the broker’s own interests.

- Leverage Options: Exness offers high leverage options on their ECN accounts, allowing traders to increase their exposure to the market without needing significant capital.

Benefits of Using Exness ECN Accounts

Traders considering an ECN account with Exness can expect several benefits:

- Cost Efficiency: Low spreads and competitive commissions make it cost-effective for frequent traders, as reduced trading costs can significantly impact overall profitability.

- Transparency: The direct market access provided by an ECN account ensures transparency, enabling traders to see real-time market prices and liquidity depth.

- Enhanced Trading Strategies: The fast execution times and tight spreads allow traders to implement a variety of strategies, including scalping, hedging, and algorithmic trading.

- Variety of Trading Tools: Exness offers a range of trading tools and resources, including informative market analyses, webinars, and a demo account to help new traders improve their skills.

Trading Conditions and Requirements

While Exness ECN accounts offer numerous advantages, it is essential to understand the trading conditions and requirements before opening an account:

- Minimum Deposit: To open an ECN account, traders typically need to deposit a minimum amount, which varies based on the trading conditions and account type.

- Commission Fees: Unlike standard accounts that may have wider spreads and no commissions, ECN accounts incur commission fees. Traders should evaluate their trading volume to determine the most cost-effective approach.

- Leverage Restrictions: While leverage can amplify potential profits, it also increases risk. ECN accounts may have specific leverage limits based on the trader’s experience and account type.

- Limited Bonuses: Some promotions and bonuses may not apply to ECN accounts, which can impact trading capital for some traders.

Potential Downsides of Exness ECN Accounts

Despite the many benefits, prospective traders should also consider the potential downsides of using an Exness ECN account:

- Set Commission Costs: While the low spreads on ECN accounts are attractive, the commission fees may add up, especially for traders with a high volume of trades.

- Market Volatility Risk: During periods of high volatility, spreads may widen excessively, impacting execution and trading costs.

- Complexity for Beginners: The ECN trading model may be overwhelming for novice traders, requiring a certain level of knowledge and experience to navigate efficiently.

Conclusion

In conclusion, the Exness ECN account is an excellent choice for experienced traders looking for low spreads, fast execution, and direct market access. While it comes with some drawbacks, such as commission fees and complexity, the potential benefits often outweigh these concerns for serious trading professionals. As always, it’s crucial to assess your trading needs, strategies, and risk tolerance before choosing the right account type. Engaging with a demo account prior to trading with real funds can offer valuable insights and help you feel more prepared for the live trading environment.